Global Service Robot Sales Increased by 30%

Published: 11.26.2024

Global sales of professional service robots surged by 30% in 2023, with over 205,000 units sold worldwide, according to the International Federation of Robotics (IFR). The Asia-Pacific region dominated the market, accounting for nearly 80% of global sales with 162,284 units. Europe and the Americas followed with 33,918 and 8,927 units, respectively.

"The service robotics industry is experiencing rapid growth," said Marina Bill, President of the IFR. "More and more robots are being deployed in factories, shopping malls, and even on city streets for delivery services."

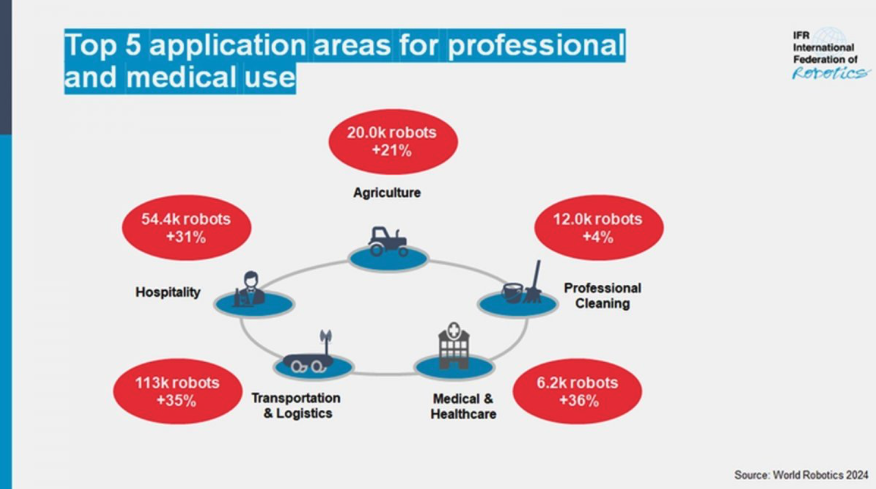

More than half of the professional service robots sold in 2023 were designed for transport and logistics applications. Sales in this sector surged by 35%, reaching nearly 113,000 units. As industries grapple with severe labor shortages, demand for automated solutions is skyrocketing.

One prime example is the trucking industry, where time-consuming tasks like loading and unloading can significantly impact efficiency. Robotic applications offer dedicated solutions to automate these processes. To accelerate adoption, it's crucial to develop user-friendly interfaces that are accessible to non-technical personnel.

The shortage of skilled workers is also driving demand for automation in outdoor environments, particularly in areas with limited public transportation. This category encompasses a wide range of robots, from automated conventional vehicles like forklifts and tractors to customized solutions designed for specific tasks and weather conditions.

The hospitality industry is embracing automation, with over 54,000 hospitality robots expected to be sold in 2023, a 31% increase. These robots primarily serve as mobile guides, information providers, and telepresence devices. As the sector evolves, new applications are emerging, including food and beverage preparation and providing information and guidance in public spaces.

The agricultural sector is also experiencing a robotic revolution. With labor shortages and the increasing demand for sustainable farming practices, agricultural robots are gaining significant traction. Sales of these robots surged 21% in 2023, approaching 20,000 units.

The professional cleaning industry is another area where robots are making inroads. Sales of professional cleaning robots increased by 4% in 2023, reaching nearly 12,000 units. Floor cleaning remains the primary application, accounting for approximately 70% of sales in this category.

The World Robotics Yearbook 2024, following ISO standards, now classifies medical robots as a distinct category alongside service and industrial robots. In 2023, medical robot sales surged by 36%, reaching approximately 6,100 units. Notably, rehabilitation and non-invasive therapy robots experienced a significant 128% increase in sales. Demand for surgical robots grew by 14%, while diagnostic robots saw a 25% increase.

The United States leads the world in the number of service and medical robot manufacturers, with 199 companies headquartered there with 66% specializing in professional service robots, 27% in consumer service robots, and 12% in medical robots.

China follows closely with 107 service and medical robot manufacturers. An impressive 80% of these companies focus on professional service robots, while 34% produce consumer robots, and 5% specialize in medical robots.

Germany secures the third position with 83 service and medical robot manufacturers. Similar to China, Germany boasts a high proportion of companies specializing in professional service robots, accounting for 79%. Consumer robots represent 17% of the market, while medical robots make up 12%.

Geographically, Europe dominates the service and medical robot manufacturing landscape, holding a 44% share of the global market. Asia follows with a 29% share, and the Americas account for 25%.

.png)